Social Security Withholding For 2024 Form

Social Security Withholding For 2024 Form. Withholding taxes from your social security payments is one way to cover your potential tax liability before tax day arrives. Your 2023 tax form will be available online on february 1,.

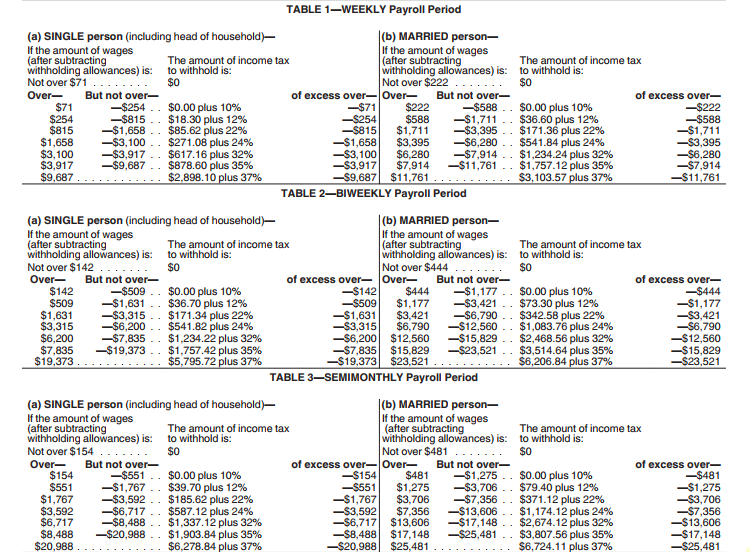

After the calculator says how much of your social security counts as income on the tax form, you add it to your other income, minus your standard (or itemized). The form only has seven lines.

Social Security Withholding For 2024 Form Images References :

Source: prudencewdebbi.pages.dev

Source: prudencewdebbi.pages.dev

Social Security Tax Limit 2024 Withholding Form Ashlan Kathrine, You file a federal tax return as an individual and your combined income is between $25,000 and $34,000.

Source: lainaqelladine.pages.dev

Source: lainaqelladine.pages.dev

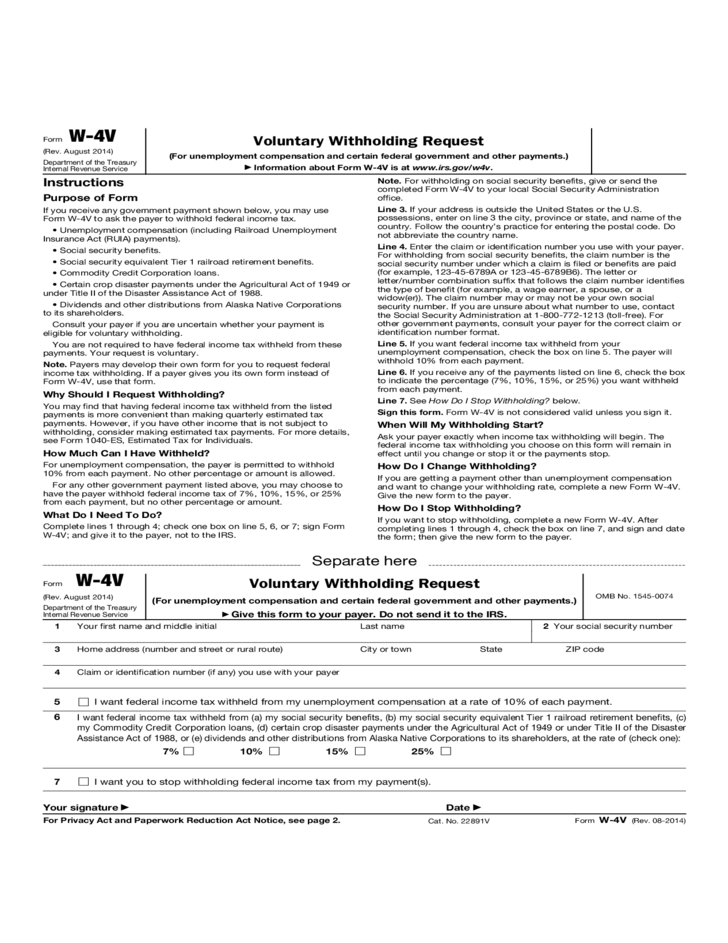

Withholding Certificate 2024 Hilde Laryssa, The annual limit is $168,600 in 2024.

Source: lainaqelladine.pages.dev

Source: lainaqelladine.pages.dev

Withholding Certificate 2024 Hilde Laryssa, The social security tax limit is set each year.

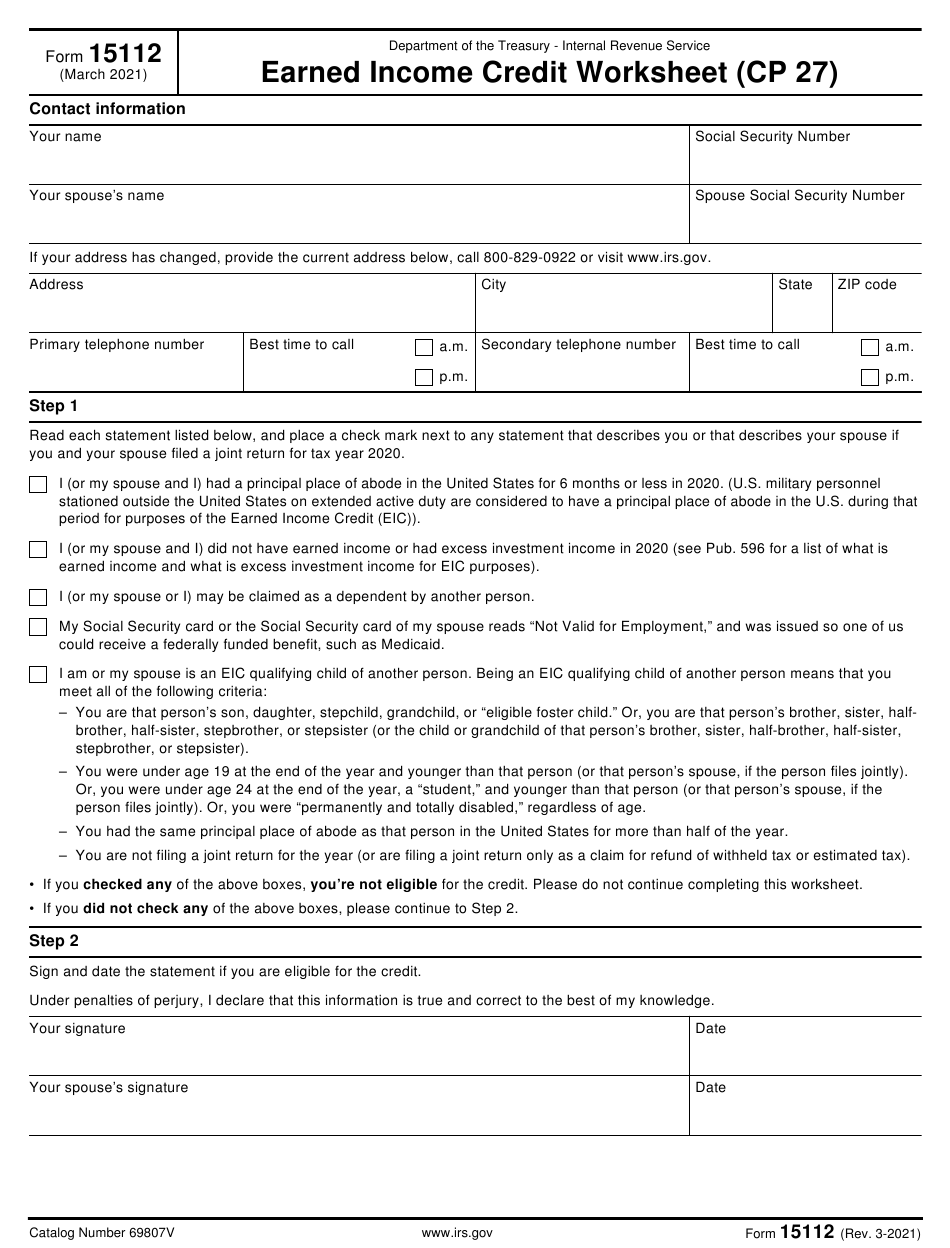

Source: www.withholdingform.com

Source: www.withholdingform.com

Federal Tax Withholding Election Form W4p, Up to 50% of your social security benefits are taxable if:

Source: loriannewalisa.pages.dev

Source: loriannewalisa.pages.dev

2024 Az Withholding Form Gates Joellen, If you get social security, you can ask us to withhold funds from your benefit and we will credit them toward your federal taxes.

Source: www.employeeform.net

Source: www.employeeform.net

Social Security Employee Withholding Form 2023, For 2024, the social security tax limit is $168,600.

Source: www.2024calendar.net

Source: www.2024calendar.net

Social Security 2024 Calendar 2024 Calendar Printable, Social security and medicare tax for 2024.

Source: guifanchette.pages.dev

Source: guifanchette.pages.dev

2024 Max Social Security Tax Withholding Rois Vivien, If you get social security, you can ask us to withhold funds from your benefit and we will credit them toward your federal taxes.

Source: www.pdffiller.com

Source: www.pdffiller.com

Fillable Online 2024 Social Security withholding form MI. 2024 Social, Social security and medicare tax for 2024.

Source: flssbreanne.pages.dev

Source: flssbreanne.pages.dev

2024 Max Social Security Tax Withholding Table Dode Nadean, A retiree can use the tax withholding estimator to enter any pension income or social security benefits they or their spouse receive.

Posted in 2024